Malpractice 2017: Do we need reform?

Malpractice reforms long espoused by Thomas E. Price, MD, Health & Human Services secretary, are fostering debate on whether national fixes are necessary in an improving liability landscape. Claims against health providers have decreased twofold and doctors nationwide have seen their premiums decrease steadily for a decade. But the numbers tell just part of the story, liability experts say.

“Most health policy and medical malpractice scholars would not describe the environment we’re in right now as a state of crisis, at least not compared to what we observed a decade ago,” said Anupam B. Jena, MD, PhD, health care policy professor at Harvard University, Boston, and a medical liability researcher.“But I would argue that malpractice is still a salient fact for most physicians. What’s much more important than focusing on changes over time is taking a static perspective and understanding the risk that a physician faces when it comes to malpractice.”

During just over 12 years in Congress, Dr. Price (R-Ga.) has consistently advocated for tort reform, proposing legislation that would restructure the lawsuit process. He supports damage caps and has recommended the creation of health care tribunals that would hear cases only after medical review. He has also proposed the development of national practice guidelines for doctors, which if followed could be used defensively.

“From exorbitant malpractice insurance premiums to the remarkably expensive practice of defensive medicine, it is my experience that the current culture of litigation costs patients hundreds of billions of dollars,” Dr. Price wrote in a 2009 commentary about his Empowering Patients First Act. “These costs do nothing to provide better care, but rather serve only as a defense against unyielding personal injury lawyers ...When malpractice suits are brought through specialized courts and viewed through the perspective of medically appropriate care, rather than a lottery mentality, we will see a decline in frivolous lawsuits.”

Data show lawsuits down

Claims data however, show that lawsuits against doctors are on the decline – and have been for more than 10 years. The rate of paid claims against physicians dropped from 18.6 to 9.9 paid claims per 1,000 physicians between 2002 and 2013, according to 2014 study by Michelle Mello of Stanford (Calif.) University and colleagues (JAMA. 2014;312(20):2146-2155. doi:10.1001/jama.2014.10705). Another analysis found that claims decreased from 12 claims per 100 doctors in 2003 to 6 per 100 doctors in 2016, according to a study of claims from The Doctors Company database.

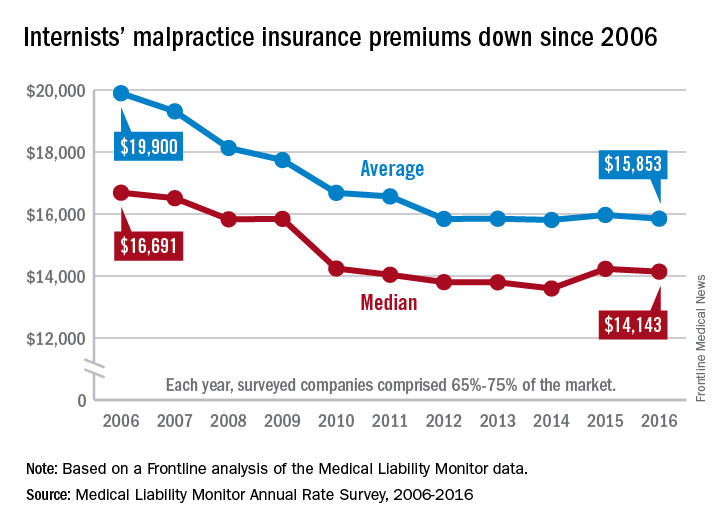

The sharp decline in claims is directly affecting premiums, which have remained nearly unchanged for years, said Michael Matray, editor of the Medical Liability Monitor (MLM), which tracks premium rates. In 2003, rate increases of 49% were commonplace, he noted, with some states reporting rises of 100%. But premiums started to fall in 2006, he said.

“We are in the midst of a 10-year soft market, the longest we’ve ever had,” Mr. Matray said in an interview. “In 2006, we started to soften. We have been soft or flat with no change since. It’s definitely unprecedented.”

In 2016, U.S. internists paid an average premium of $15,853, compared to an average premium payment of $19,900 in 2006 without inflation adjustment, according to this news organization’s analysis of MLM data. General surgeons meanwhile, paid an average of $52,905 in premiums in 2016, compared to a 2006 average of $68,186. Ob.gyns. paid an average premium of $72,999 in 2016, a drop from $93,230 in 2006.

“Generally speaking, it’s great for doctors,” Mr. Matray said. “Even if you remove the inflationary factor, there are some states where they are paying less now than they were 10 years ago.”

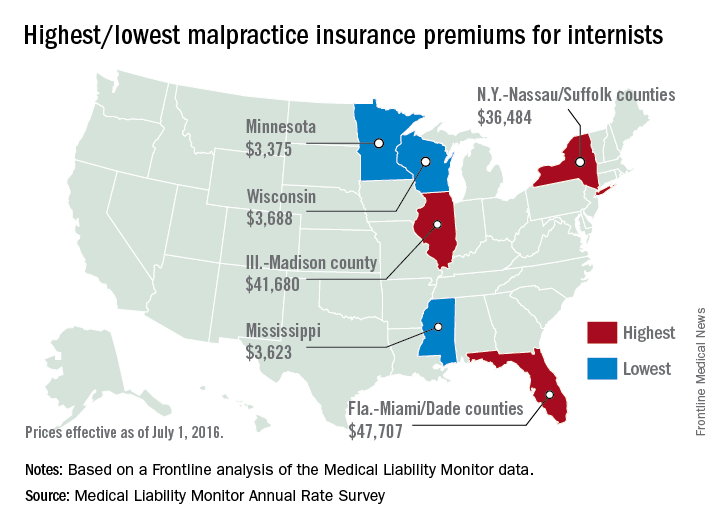

But stable premiums do not mean inexpensive insurance, noted Mike Stinson, vice president of government relations and public policy for the PIAA, a national trade association for medical liability insurers.

“They’ve certainly come down over the last few years,” Mr. Stinson said in an interview. “But they certainly are not low.”

South Florida doctors for example, are paying among the highest premiums in the nation despite an overall drop in the last 10 years. Internists in Dade County, Fla., paid $47,707 for insurance in 2016, $27,000 less than in 2006, according to MLM data. Coverage is still is not affordable, said Jason M. Goldman, MD, an internist in private practice in Coral Springs, Fla., and governor for the American College of Physicians Florida chapter.

The premiums are ridiculous,” he said in an interview. “That’s one of the reasons I went bare. Having medical insurance makes you a target, because lawyers think, ‘We can sue the insurance company and the insurance company is going to pay.’ ”